Market Overview:

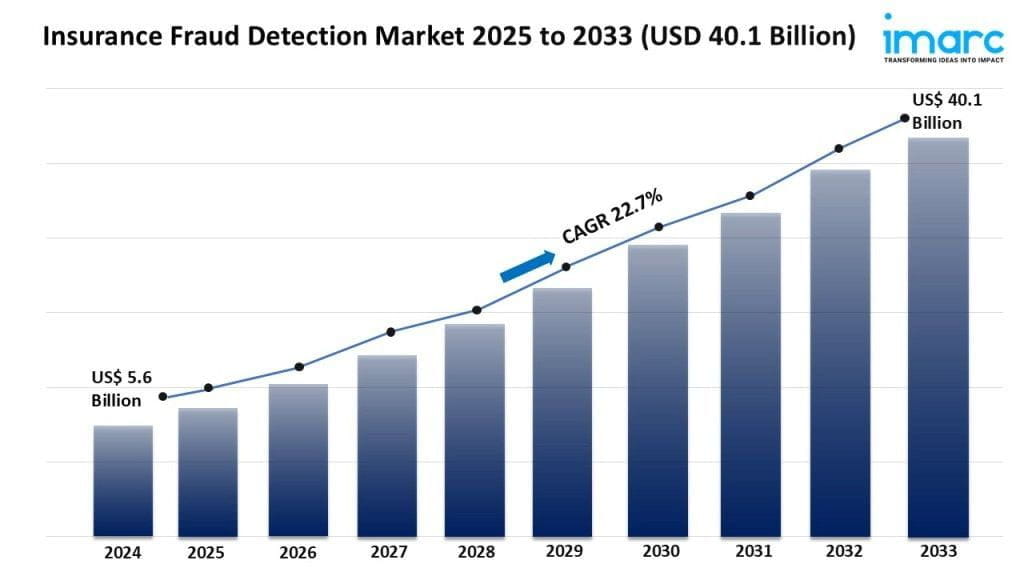

- The global insurance fraud detection market size reached USD 5.6 Billion in 2024.

- The market is expected to reach USD 40.1 Billion by 2033, exhibiting a growth rate (CAGR) of 22.7% during 2025-2033.

- North America leads the market, accounting for the largest insurance fraud detection market share.

- Blockchain's immutable ledger is poised to revolutionize insurance fraud detection, establishing a transparent and secure foundation for verifiable claims.

- The fusion of blockchain's trust infrastructure with automated claims verification is streamlining processes and drastically reducing opportunities for fraudulent activity.

- Real-time telematics data, coupled with sophisticated analytics, is empowering insurers to proactively identify and mitigate fraudulent claims by revealing discrepancies in user behavior.

- By leveraging blockchain's inherent security features, insurers can create a tamper-proof environment, ensuring the integrity of transaction and claims data from inception.

- The convergence of blockchain and telematics is ushering in a new era of data-driven fraud prevention, where verifiable records and behavioral insights combine to safeguard the insurance industry.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/insurance-fraud-detection-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Factors Affecting the Growth of the Insurance Fraud Detection Industry:

- Advancements in Artificial Intelligence (AI) and Machine Learning (ML) Technologies:

Advances in artificial intelligence (AI) and machine learning (ML) are making it easier for insurance companies to detect and prevent fraud. AI and ML algorithms can rapidly analyze large amounts of data, identifying patterns and anomalies that may indicate fraudulent activity. This enables insurers to quickly review claims and transactions, reducing the time and resources needed for manual investigations. As more data becomes available, AI-driven systems learn from it, becoming increasingly accurate and efficient. This helps insurers uncover sophisticated fraud schemes and respond to new fraudulent tactics. Insurers are saving a lot of money each year by using AI and ML for fraud detection. These technologies help reduce losses from fraud.

- Increasing Digital Transactions in the Insurance Sector:

More people are turning to online platforms for their insurance needs. They use these platforms to buy policies and file claims. This shift creates chances for fraud. To fight this, we need advanced fraud detection solutions. These tools watch and study digital transactions as they happen. They find and prevent fraud quickly. Securing digital transactions is vital to keep user trust and protect the financial health of insurance companies. The need for effective fraud detection tools is rising, pushing the market forward. These tools use technologies like predictive analytics, data mining, and behavioral analytics to prevent fraud in a thorough way.

- Regulatory Compliance and Pressure to Reduce Losses:

Many countries' governing agencies and regulatory bodies are introducing stricter regulations to combat insurance fraud. This means insurance companies must adopt advanced fraud detection and prevention measures. The main goal of these regulations is to protect individuals and maintain the integrity of the insurance industry. To comply with these regulations and avoid penalties and reputational damage, insurance companies are investing in fraud detection solutions. Insurance fraud causes significant financial losses each year, which is a major concern for insurers. By using advanced fraud detection technologies, insurance companies can reduce these losses, improve their profitability, and stay competitive in the market.

Leading Companies Operating in the Insurance Fraud Detection Industry:

- ACI Worldwide Inc

- BAE Systems plc

- Equifax Inc.

- Experian plc

- Fair Isaac Corporation

- Fiserv Inc.

- FRISS

- International Business Machines Corporation

- Lexisnexis Risk Solutions Inc. (RELX Group plc)

- SAP SE

- SAS Institute Inc.

Insurance Fraud Detection Market Report Segmentation:

By Component:

- Solution

- Services

Solution exhibits a clear dominance in the market accredited to its crucial role in providing essential tools and technologies needed for detecting and preventing fraudulent activities in insurance claims and processes.

By Deployment Model:

- Cloud-based

- On-premises

On-premises represents the largest segment attributed to its enhanced security features and control over the infrastructure for sensitive data handling in fraud detection.

By Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises hold the biggest market share owing to their substantial resources and higher volumes of claims, making them more likely to invest in comprehensive fraud detection systems.

By Application:

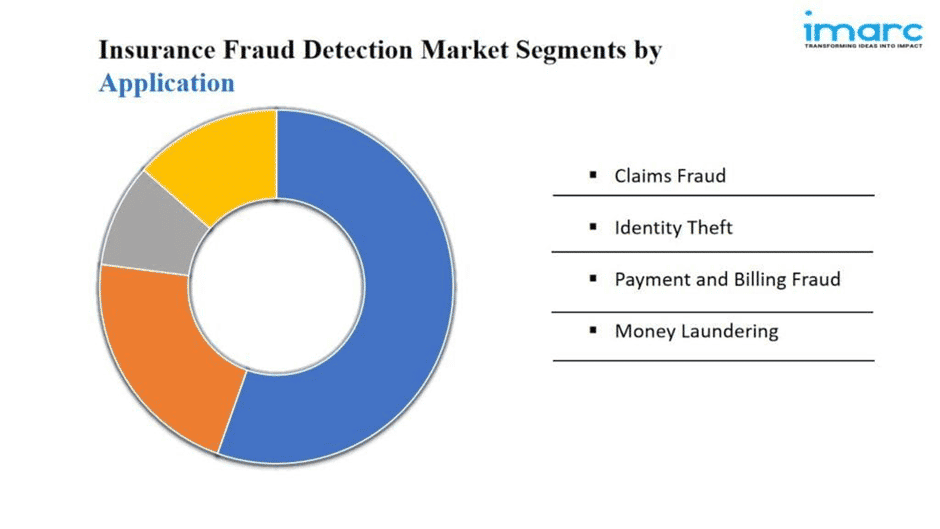

- Claims Fraud

- Identity Theft

- Payment and Billing Fraud

- Money Laundering

Payment and billing fraud account for the majority of the market share. They are the most common and financially impactful types of fraud affecting insurance companies.

By End User:

- Insurance Companies

- Agents and Brokers

- Insurance Intermediaries

- Others

Insurance companies represent the largest segment, as they are the primary users of fraud detection solutions to protect their operations and finances.

Regional Insights:

- North America: (United States, Canada)

- Asia Pacific: (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe: (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America: (Brazil, Mexico, Others)

- Middle East and Africa

North America dominates the market due to the high concentration of insurance companies, the implementation of stringent regulatory reforms, and the rising investments in advanced technologies for fraud detection.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145