Market Overview:

The mobile phone insurance market is experiencing rapid growth, driven by rising smartphone costs, eco-conscious repair trends, and embedded insurance growth. According to IMARC Group’s latest research publication, ”Mobile Phone Insurance Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033″. The global mobile phone insurance market size was valued at USD 40.28 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 83.1 Billion by 2033, exhibiting a CAGR of 8.4% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/mobile-phone-insurance-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Factors Affecting the Growth of the Mobile Phone Insurance Industry:

- Rising Smartphone Costs:

Rising prices of flagship smartphones are boosting demand for mobile phone insurance. Devices like the latest iPhone and Galaxy models now cost over $1,000. Consumers want protection against theft, loss, or damage. Insurers now offer flexible plans. These include monthly subscriptions and bundled coverage. They aim to attract buyers who are mindful of their budgets. This trend is especially strong among younger customers. They value device security but want to avoid high upfront costs.

- Eco-Conscious Repair Trends:

Sustainability concerns are changing how people choose mobile insurance. Now, consumers prefer policies that focus on repairs instead of replacements. This approach reduces e-waste and helps devices last longer. Insurers are teaming up with certified repair networks to provide eco-friendly claims. This appeals to customers who care about the environment. This trend helps global sustainability goals, so "green insurance" is vital in a competitive market.

- Embedded Insurance Growth:

Carriers and retailers are now offering insurance at the point of sale. When customers buy a new phone, they get instant coverage. This removes the hassle of separate purchases. This easy approach increases uptake, especially for less tech-savvy users. Partnerships between manufacturers, insurers, and telecom providers are speeding up this trend. Embedded insurance is becoming a key distribution model.

Leading Companies Operating in the Global Mobile Phone Insurance Industry:

- American International Group, Inc

- Allianz SE

- AmTrust International Limited

- Apple Inc., AT&T Inc.

- AXA Group

- Deutsche Telekom AG

- Liberty Mutual Insurance Group

- Pier Insurance Managed Services Ltd.

- Samsung Electronics Co. Ltd.

- SoftBank Group Corp.

- Sprint Corporation

- Telefónica Insurance S.A.

- Verizon Communications Inc.

- Vodafone Group Plc

- Xiaomi Corporation

- Orange S.A.

Mobile Phone Insurance Market Report Segmentation:

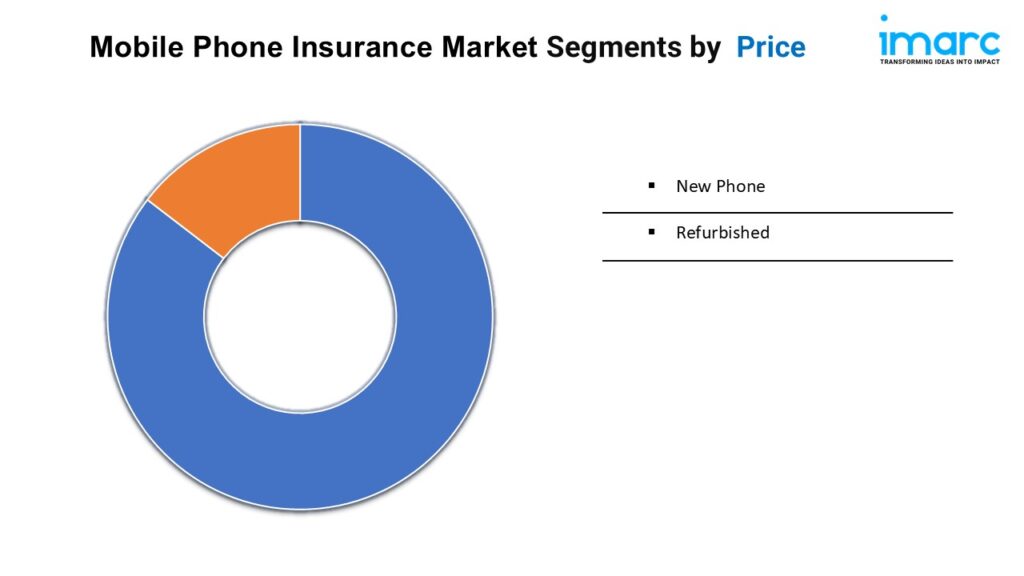

By Phone Type:

- New Phone

- Refurbished

The new phone represented the largest segment due to the rising need to reduce high replacement costs.

By Coverage:

- Physical Damage

- Electronic Damage

- Virus Protection

- Data Protection

- Theft Protection

Physical damage accounted for the largest market share as it provides protection for mobile phones against external harm, such as accidental drops and spills.

By Distribution Channel:

- Mobile Operators

- Device OEMs

- Retailers

- Online

- Others

Online exhibits a clear dominance in the market on account of the increasing focus on enhanced convenience and accessibility.

By End User:

- Corporate

- Personal

Personal holds the biggest market share as mobile phone insurance provides protection against numerous risks, such as accidental damage, theft, loss, and damage caused by environmental factors.

Regional Insights:

- North America: (United States, Canada)

- Asia Pacific: (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe: (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America: (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position in the mobile phone insurance market due to the presence of numerous insurance providers.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145